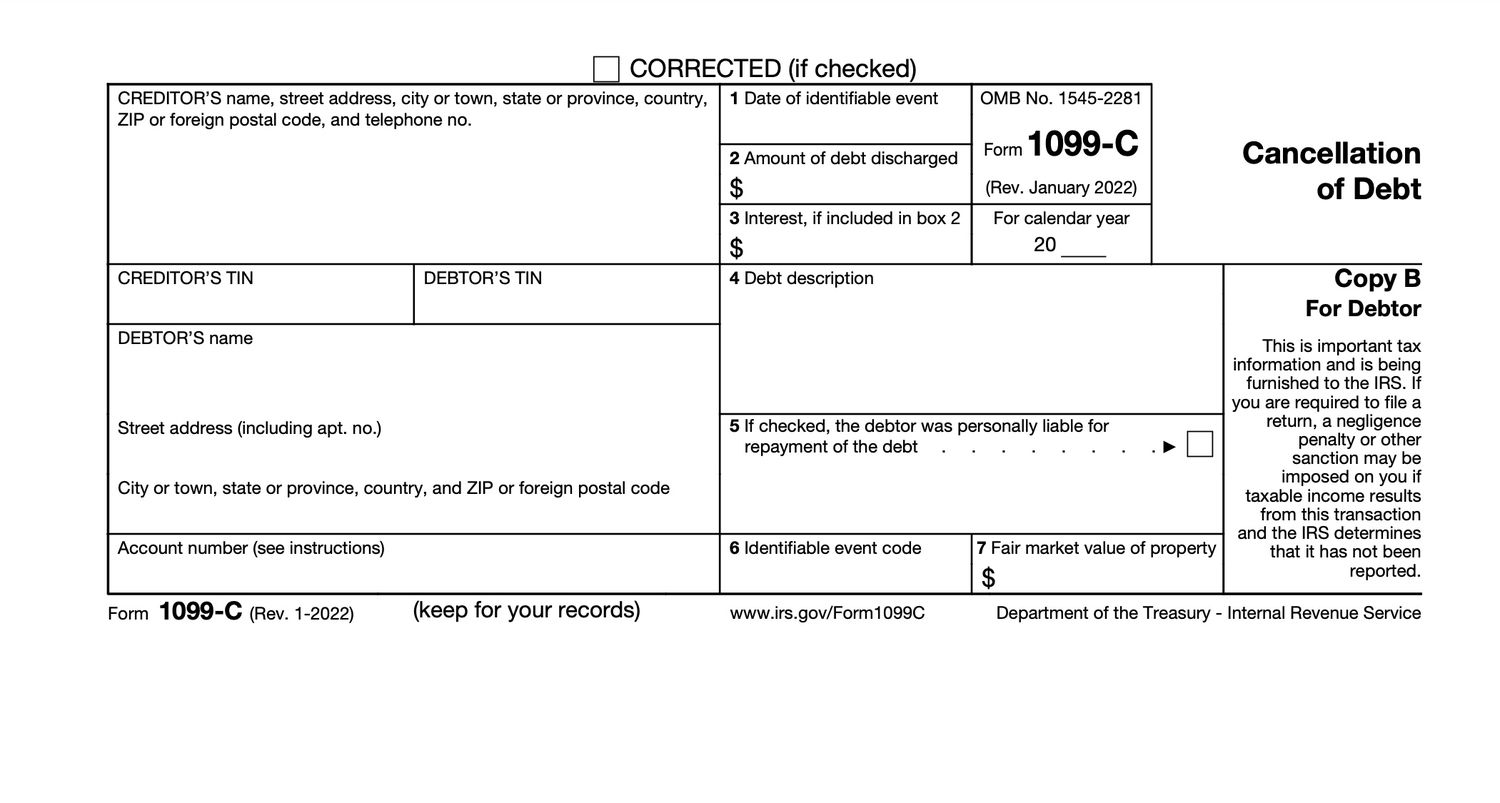

Now that it is tax time, today I got a call from a panicked client who is getting a 1099 on a credit card. Have you received a Form 1099-C Cancellation of Debt after your bankruptcy discharge? Don’t panic! Here’s a quick guide:

Why did you get it?

Normally, if a creditor cancels a debt over $600 outside of bankruptcy, it’s reported to the IRS. The cancelled debt is considered “income” for tax purposes.

But what if the debt was discharged in bankruptcy?

In bankruptcy, the debt isn’t canceled; it’s discharged, meaning the creditor can’t collect. Some creditors issue a 1099-C anyway, which can be confusing.

What should you do?

- Don’t ignore it!

- The IRS says debts discharged in bankruptcy aren’t income (26 U.S.C. § 108).

- If you get a 1099-C, use Form 982 for tax filing. Check the box for “Discharge of indebtedness under a Title 11 case” (Bankruptcy Code).

- Include a copy of your bankruptcy discharge order.

- Submit these to the IRS with your tax documents or through your tax professional.

Follow these steps, and you’re unlikely to face any difficulties. If you need assistance, reach out to us.

Now if you did not file bankruptcy and negotiated a credit card or other debt, you will need to report that 1099 C to the IRS as additional income. Another reason why sometimes bankruptcy is better than just settling your credit cards. If you do choose to debt settlement, make sure you reserve enough money to pay taxes on your savings so you don’t end up with the IRS knocking on your door.

If your credit card balances are keeping you up at night and you feel you can’t keep up with your payments reach out to us to discuss your options and which option is best for you. Call us today at 732-333-0681